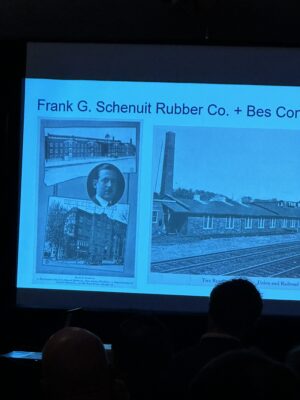

Schenuit Industries

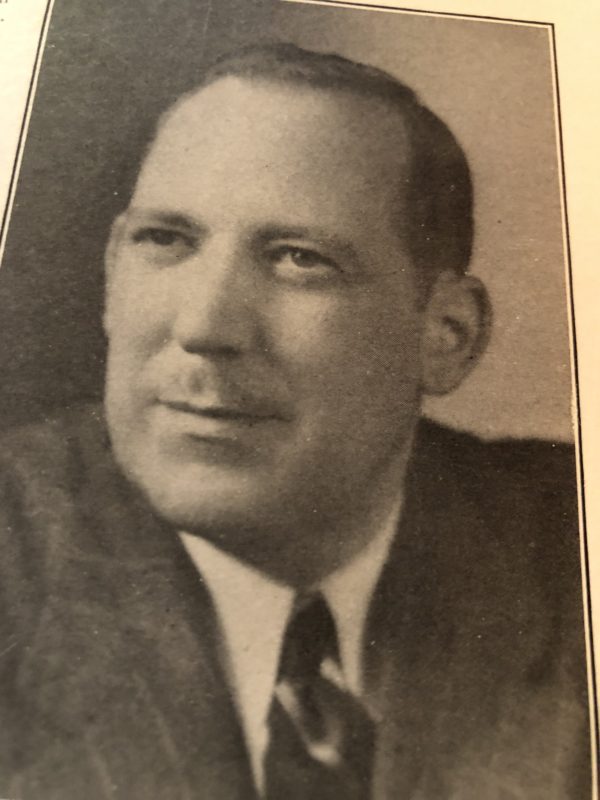

Frank G. Schenuit was the son of Alfons Schenuit a famous musician, Frank and my mom Below in his plane

Frank G Schenuit was a very successful Baltimore entrepreneur and was developer of the Schenuit Tire company .

Companies Schenuit bought

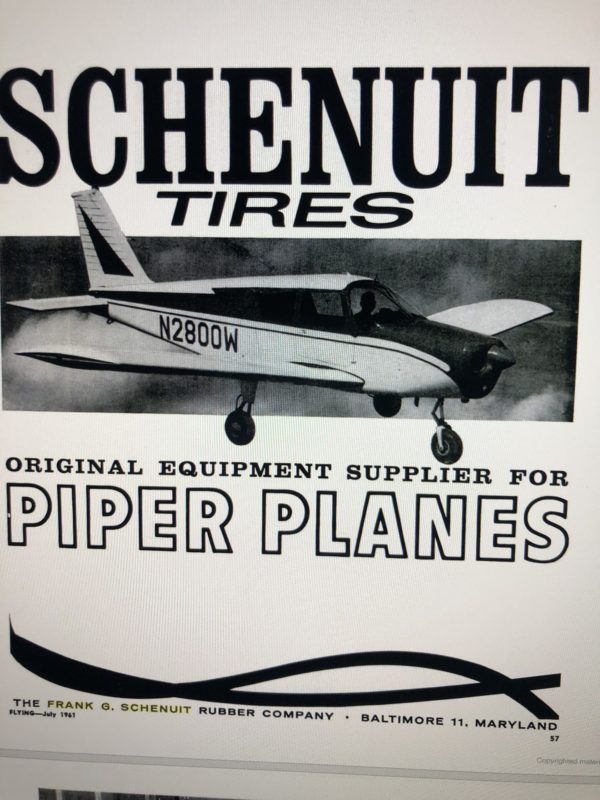

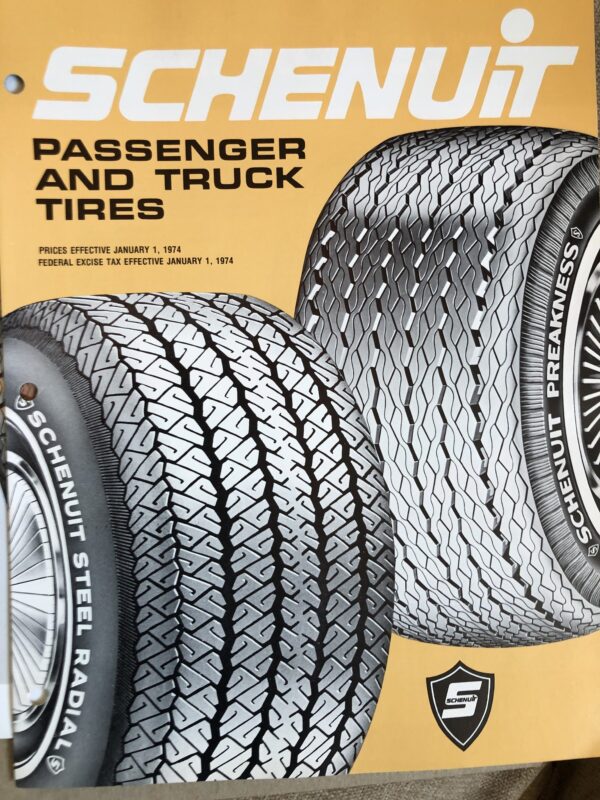

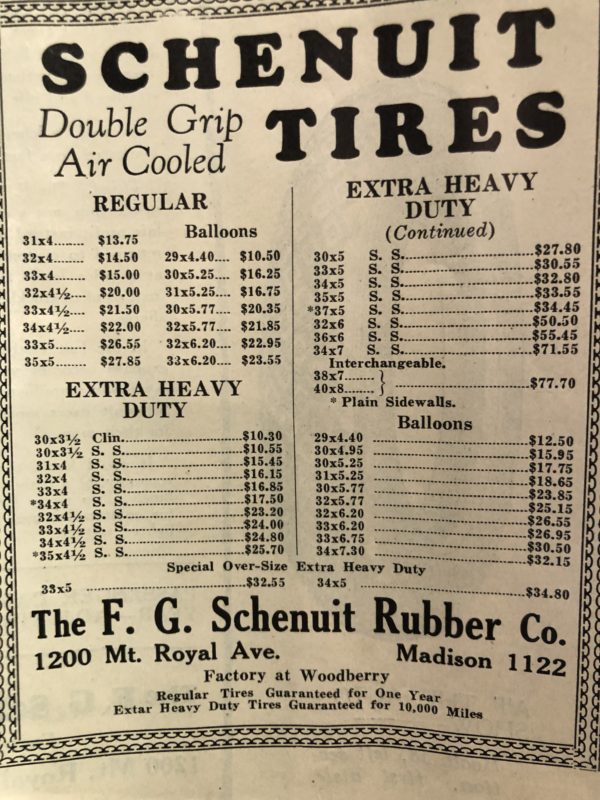

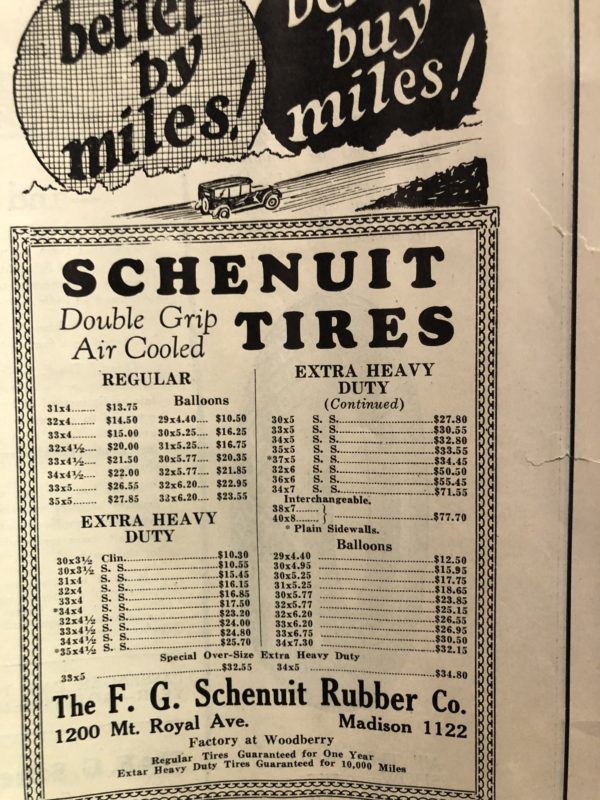

The Tire Company below

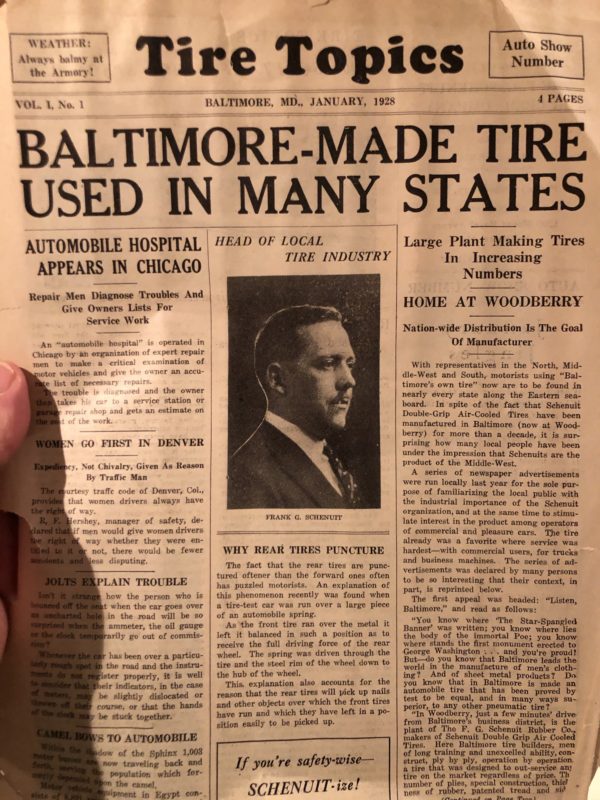

He also patented a non-skid pneumatic tire he called the Double Grip.

By 1921 he patented the double grip tire and also built his own manufacturing facility producing “Schenuit Tires”. The plant grew tremendously and they made tires for the United Sates Government aircraft during the war and afterwards.

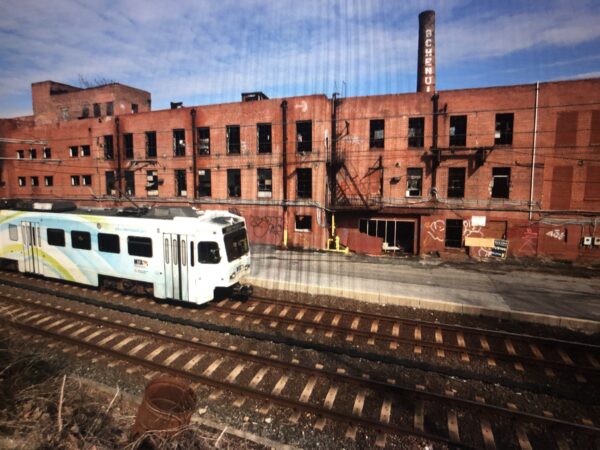

In 1928, Later he bought a former Woodberry cotton mill. He moved his tire making facility to that Woodberry plant (Below) where he turned out thousands of aircraft tires during World War II not only for commercial planes but also the Military

Ever since Frank G. Schenuit, opened his Double Grip tire factory, his name has been associated with a campus of industrial Woodberry buildings. Frank left a lasting legacy when he had his name spelled out in bricks on the plant’s landmark chimney (above).

According to Baltimore Sun articles, by 1925 Baltimore’s Mayor Howard Jackson as well as officials of the old State Roads Commission and the Maryland Motor Vehicles Commission were admiring Schenuit’s new Woodberry plant.

The Sun’s account of the tire plant opening described the Pennsylvania Railroad’s tracks that ran alongside the building, making it easy to ship in raw materials and ship out tires. “Two huge steam boilers, of 210 horsepower, deliver the steam for the curing process,” The Sun reported, adding that the water for the steam came from the adjoining Jones Falls. The plant initially employed 100, but that changed as Schenuit’s sales increased. He was forced to rebuild his whole operation in late 1929 after a major fire destroyed the plant.

The Sun said that the flames were visible all over the city and that 10,000 people assembled to observe the blaze.

Schenuit advertised “direct factory prices” and pledged that “every Schenuit tire is made in Baltimore,” urging his customers to “patronize local industry and help Baltimore prosper.” The plant went into overdrive during World War II, as did other foundries and industries along the Jones Falls Valley. Toward the end of the war, he supervised another extension of his plant to keep up with demand. The plant was then running three shifts a day and had the biggest backlog of orders in its history.

In 1939, Schenuit entered the aircraft tire field, and with the onset of World War II, produced mostly military aircraft tires. During the post-war period, Frank resumed production of automotive tires.

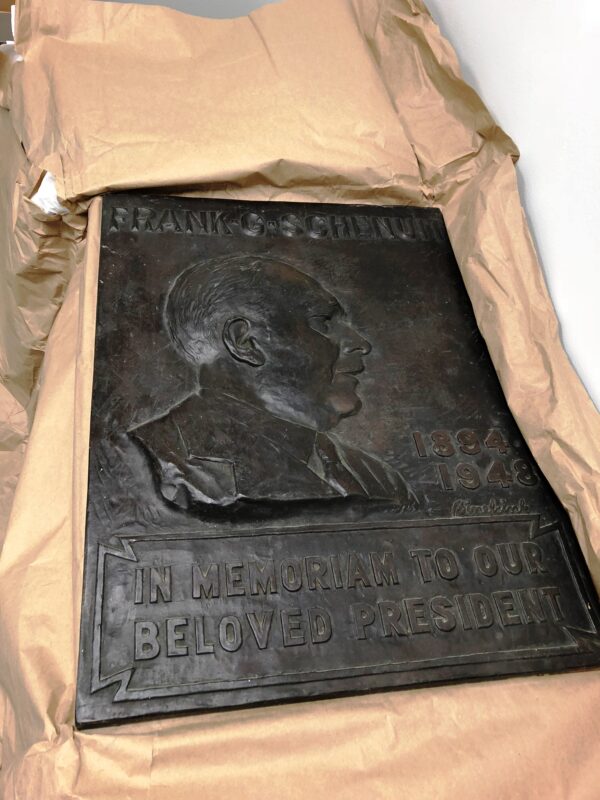

Frank operated as a sole proprietorship until 1945, and then Frank incorporated. The Employees donated this plaque in honor of Frank with his passing

Following Mr. Schenuit’s death in 1948, the ownership of all stock passed to his three daughters. Back then, the president and active head of the corporation from 1948 until 1963 was Roy Neely.

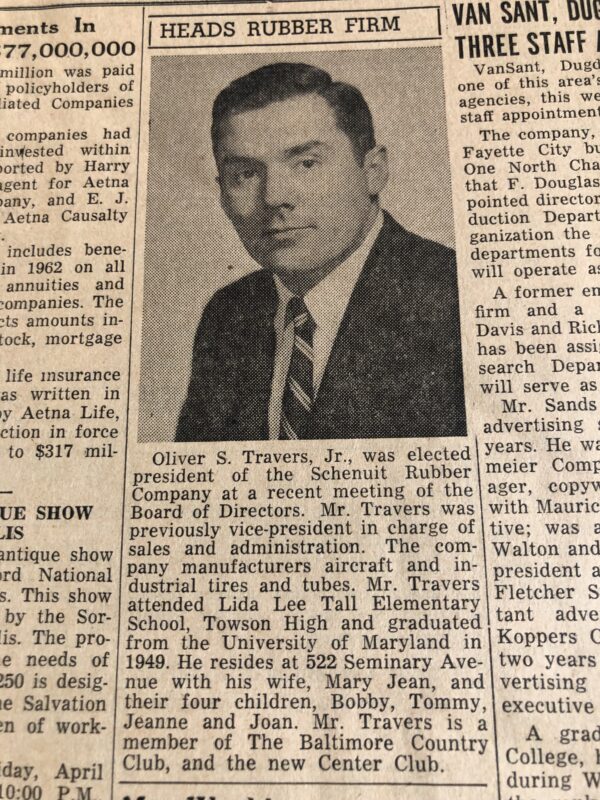

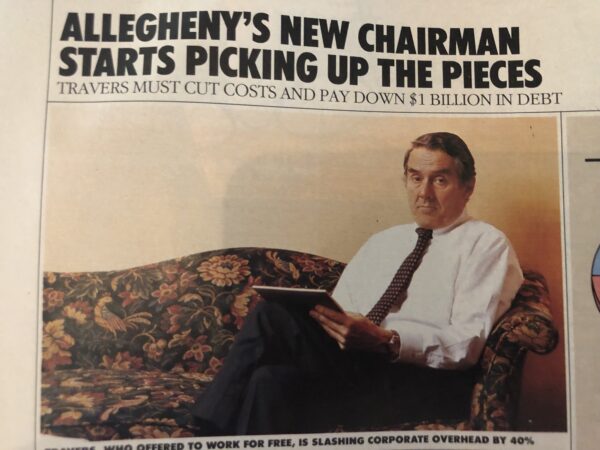

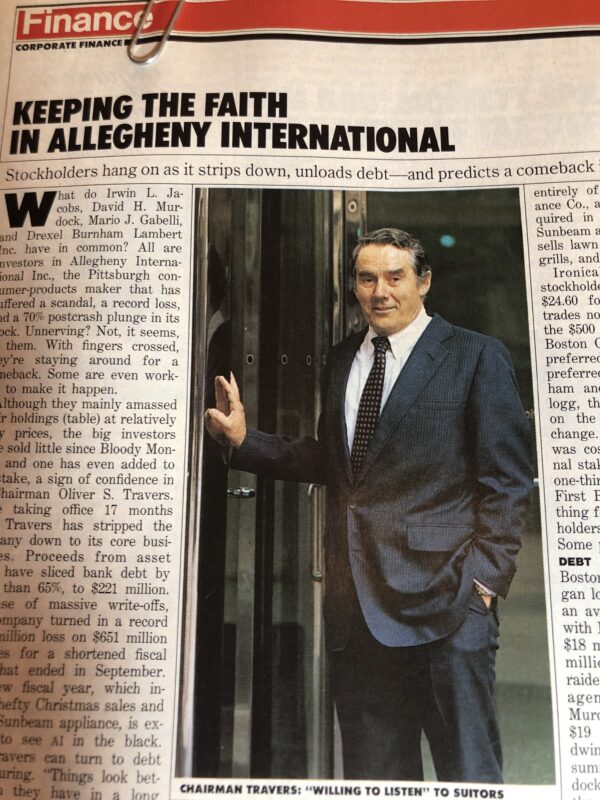

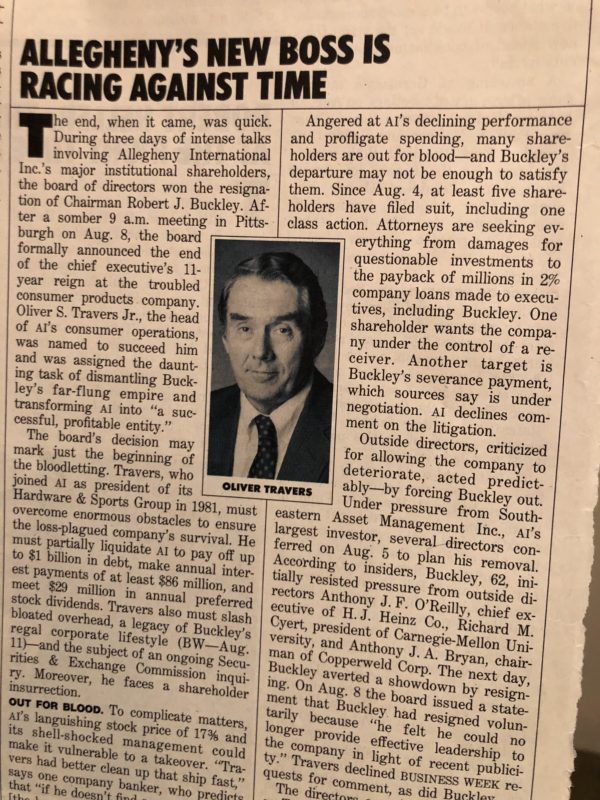

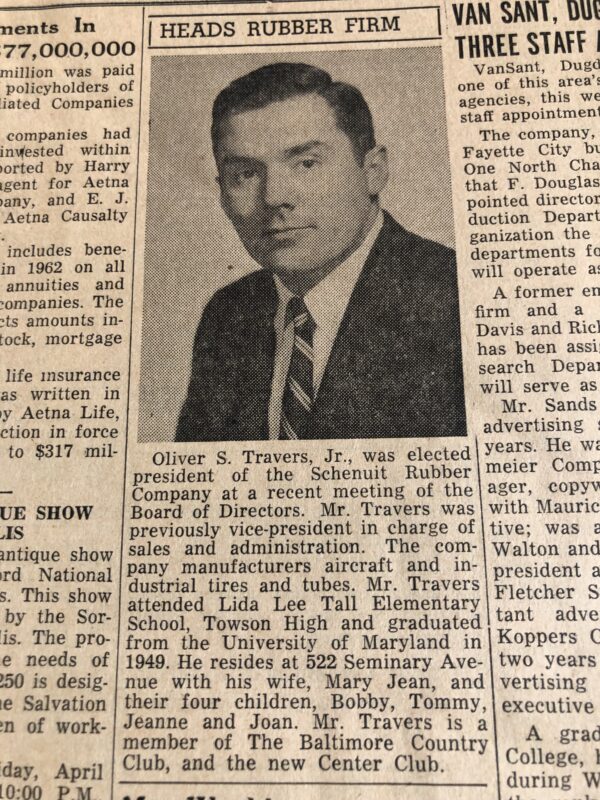

Edgar H. Spilman, Albert E. Thompson and Oliver S. Travers – pictured above on right, the husbands of the stockholders, entered the business in 1945, 1948 and 1953 respectively; and were officers and directors. Edgar Spilman resigned and was succeeded as a director by his wife.

Back to its business: In 1949 Schenuit decided to began marketing through distributors with an increasing emphasis on the manufacture of non-automotive industrial tires, with sales primarily to equipment manufacturers, and Schenuit resumed the manufacture and sale of aircraft tires for private planes. After the start of the Korean War in 1950, sales of military aircraft tires became the major part of Schenuit’s business again. Schenuit saw business increase substantially from 1949 to 1960.

During the eight years ending April 30, 1955, Schenuit had made major improvements to increase plant capacity and to modernize its production, research and testing equipment. During the fiscal years 1956-1962, inclusive, Schenuit spent $3,964,436 for fixed assets.

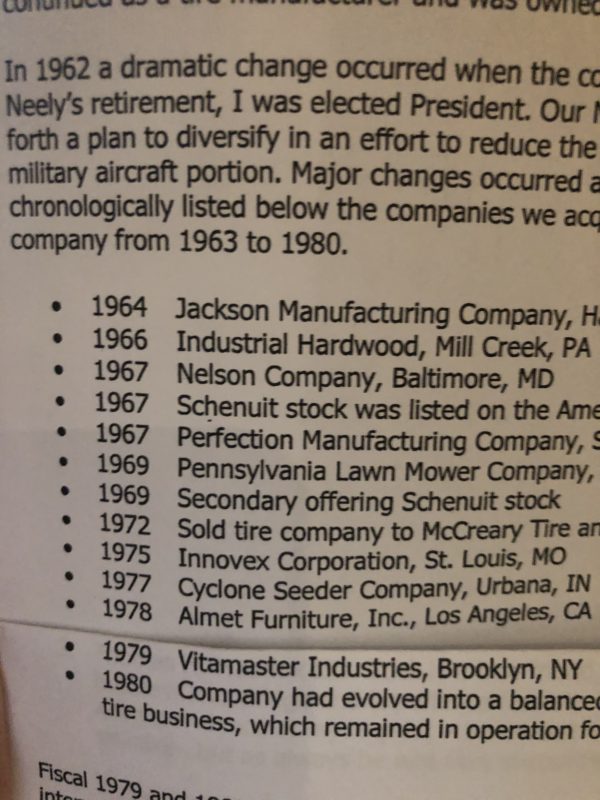

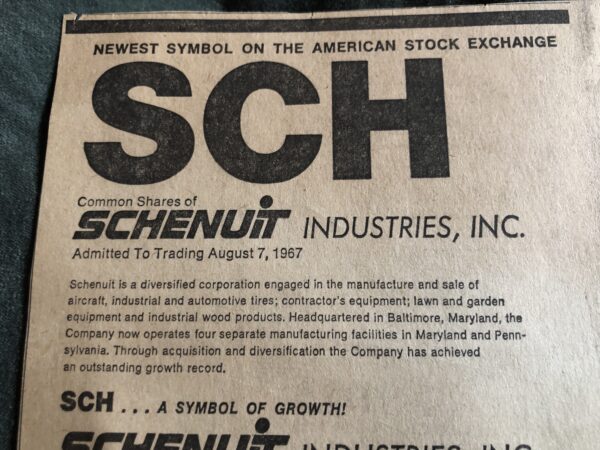

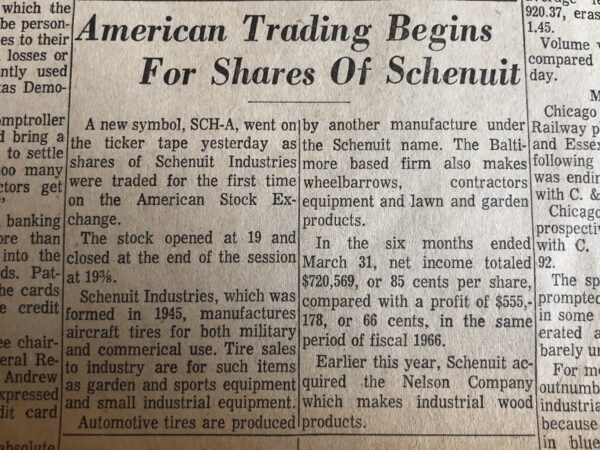

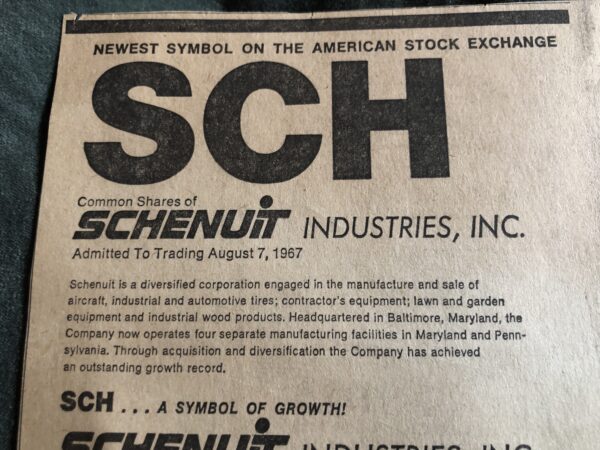

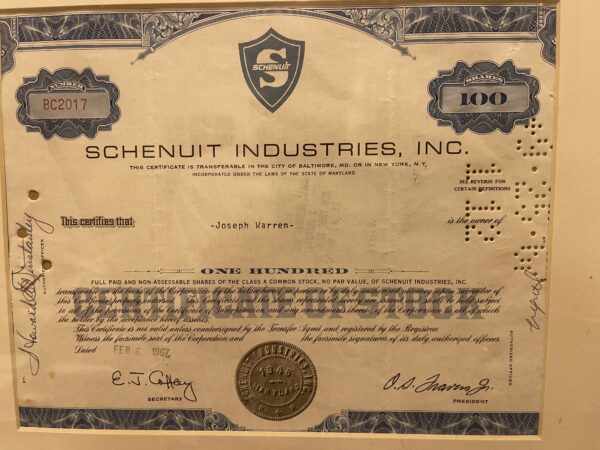

My father, Oliver Travers became president and he saw the need to diversify and so he did a secondary offering to raise money to purchase other companies . On April 25, 1962, a public secondary offering of 240,000 shares of the Class A common stock was made to the public at a price of $14 a share or a total of $3,360,000. They expanded and here is what they owned and purchased

These are the businesses that dad, “Oliver” ran and owned. HE took Schenuit public in 1962, then he bought Jackson Wheel barrow in 1963, then Nelson pallet company 1966, then PErfectin in 1967, then Pennsylvania Products in 1969, then Innovex Inc in 1975, Then Almet in 1978 and then Vitamaster in 1979. HE sold Schenuit to Alleghany Ludlum and then he became president of the firm – = a multi-national firm with about 4oo subisidiears around the world including Wilkensen pictured below

Ok so Dad went to work for the Schenuit Tire Company that his father in law Frank Schenuit, had started .

Following Mr. Schenuit’s death in 1948, the ownership of all stock passed to his three daughters. Back then, the president and active head of the corporation from 1948 until 1963 was Roy Neely.

My father, Oliver Travers became president and he saw the need to diversify and so he did a secondary offering to raise money to purchase other companies . On April 25, 1962, a public secondary offering of 240,000 shares of the Class A common stock was made to the public at a price of $14 a share or a total of $3,360,000.

My Father, Oliver Travers as president purchased: * The Nelson Pallet Company which is a global pallet corporation operating in Baltimore since 1918 located at Sparrows Point,

The Nelson Pallet Company above

Then Ollie as president purchased the Jackson Wheelbarrow Company in Harrisburg Pennsylvania as well as other companies. The Jackson Wheelbarrow company makes 85% of the wheelbarrows in North America. When Hurricane Agnus hit the plant was flooded but it survived and today it is owned by Ames

Schenuit was listed on the S&P and then about 1985 my father sold all the assets to Allegheny Ludlum. He was brought into Allegheny to run the “Schenuit ” companies

and then he was made president of the Multi National multi Billion dollar company. Allegheny Ludlum had about 450 subsidiaries around the globe.

My Father, Oliver Travers as president purchased: * The Nelson Pallet Company which is a global pallet corporation operating in Baltimore since 1918 located at Sparrows Point,

The Nelson Pallet Company above

Then Ollie as president purchased the Jackson Wheelbarrow Company in Harrisburg Pennsylvania as well as other companies. The Jackson Wheelbarrow company makes 85% of the wheelbarrows in North America. When Hurricane Agnus hit the plant was flooded but it survived and today it is owned by Ames

As Schenuit was a unionized company by the United Rubber Workers they had to deal with striking employees. They never came to an agreement so my father closed the plant and sold it to McCreary Tire and Rubber (not the Schenuit Corporation)

Schenuit was listed on the S&P and then about 1985 my father sold all the assets to Allegheny Ludlum. He was brought into Allegheny to run the “Schenuit ” companies

and then he was made president of the Multi National multi Billion dollar company. Allegheny Ludlum had about 450 subsidiaries around the globe.

One of the Great companies was Gillett . Gillett makes all the ceremonial swords for Royalty in the world so I have swords actual duplicates of : the swords Price Charles wore on his wedding day, the Olympic sword presented to the olympic committee and so on

My dad eventually took the Allegheny corporation (not Schenuit) into bankruptcy and then he retired

It all started from Frank Schenuit below and then my dads hard work and proper management .

Alfons his father below

THE HISTORY IN DETAIL

The Schenuit story began in 1912 when Frank Schenuit, as a young man, started making tires for racing motorcycles in his tire shop at 1200 Mount Royal Ave as well taking over the distribution of the Pennsylvania automobile tire and was associated with the India Rubber Company of Akron Ohio.

Frank G. Schenuit, began to manufacture automotive tires around 1912, and in 1928 opened a factory in the Jones Falls Valley in Baltimore. He operated as a sole proprietorship until 1945, when taxpayer was incorporated. In 1939, Schenuit entered the aircraft tire field, and with the onset of World War II, produced little but military aircraft tires. During the post-war period, Schenuit resumed production of automotive tires. Its retail outlet proved unprofitable, however, and in 1949 Schenuit began marketing through distributors. Thereafter placed increasing emphasis on the manufacture of non-automotive industrial tires, with sales primarily to equipment manufacturers, and resumed the manufacture and sale of aircraft tires for private planes. After the start of the Korean War in 1950, sales of military aircraft tires became the major part of its business.

During the eight years ending April 30, 1955, Schenuit made gross additions of $937,481 to its plant. In 1955 it embarked on a program to increase plant capacity and to modernize its production, research and testing equipment. So, during the fiscal years 1956-1962, they spent $3,964,436 for fixed assets, and the net additions to fixed assets

During those years taxpayer’s principal lines of business were military aircraft tires and industrial tires. Its automotive tire sales had dropped to about 11 percent of its business.

Schenuit’s military aircraft tire sales fluctuated with the government’s needs and procurement policies. Before February 1961, prices of tires and tubes sold to the armed forces were taken from GSA’s Federal Supply Schedule, which was determined by annual government-industry negotiation. In February 1961, however, the government began requiring competitive bids on all contracts involving more than $100,000, and by the end of May 1962, all government contracts had been placed on a competitive bid basis. During the period of changeover to competitive bidding, Schenuit’s government business declined sharply, and its net income after taxes dropped from $985,700 in fiscal 1961 to $740,979 in fiscal 1962 and to $78,082 in fiscal 1963.

So it look to increase profits by diversifying production into industrial tire production embraced tires and tubes for a wide variety of products, including garden equipment, sporting appliances and miscellaneous small industrial equipment.

Following Mr. Schenuit’s death in 1948, the ownership of all stock issued by taxpayer passed to his three daughters. Each then owned 248 1/3 shares of its one-class stock, and an undivided one-third interest as tenants in common in $200,000 subordinated 6% notes.

The president and active head of the corporation from 1948 until 1963 was Roy Neely, who had grown up in the business, but owned no stock or other proprietary interest therein.

Edgar H. Spilman, Albert E. Thompson and Oliver S. Travers, the husbands of the stockholders, entered the business in 1945, 1948 and 1953 respectively; and were officers and directors until 1959, when Edgar Spilman resigned and was succeeded as a director by his wife. The other directors during the tax years in question included Neely (taxpayer’s president and treasurer), Theodore R. Dankmeyer (an attorney), Ernest E. Wooden (a CPA), John D. Wright (an attorney specializing in tax matters, who joined the Board in 1959), and two minor officers of the company.

In fiscal 1956, Schenuit declared a stock dividend on its common stock of 9,005 shares, with a total par value of $900,500. In fiscal 1960, the common stock was again split, and an additional 9,750 shares were issued with a total par value of $975,000. In each instance, the additional stock was issued at the suggestion of Wooden, to transfer from earned surplus to capital stock the increased investment in plant and equipment. See balance sheet for the year ending April 30, 1961, in Schedule A.

Schenuit paid no cash dividends until 1955. From fiscal 1955 through fiscal 1958, it paid a token dividend on its common stock because the directors believed it was necessary to conserve cash for various purposes, which will be discussed in detail below.

On April 25, 1962, a public secondary offering of 240,000 shares of the Class A common stock was made to the public at a price of $14 a share or a total of $3,360,000. The net proceeds to the selling shareholders, after expenses, underwriters’ discounts and commissions, which were borne by the selling shareholders, totaled $3,060,000. The shareholders did not sell any of the Class B common shares. The three selling shareholders retained 53,250 shares, or 18.15 percent of the Class A stock and 282,750 shares, or 100 percent, of the Class B stock.